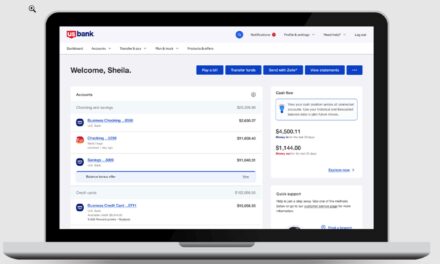

Boost Your Small Business

Connecting small business owners to the best new financial technology

to manage, grow and protect your business.

Rankings

| FAB Score* | Founded | Funding $M | ||

|---|---|---|---|---|

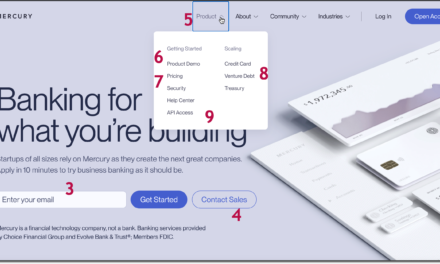

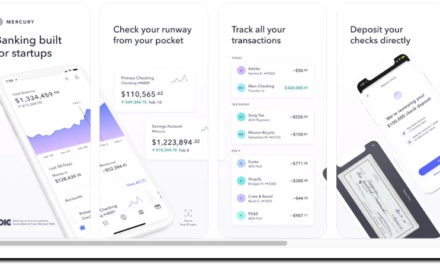

| http://fintechlabs.com/wp-content/uploads/2021/12/Murcury-logo-square.jpg | 447 | SF | 2017 | $152 |

| http://fintechlabs.com/wp-content/uploads/2022/01/Novo-logo-square.jpg | 327 | NYC | 2016 | $296 |

| http://fintechlabs.com/wp-content/uploads/2023/05/BluevineLogo.png | 260 | SF | 2013 | 768 |

| http://fintechlabs.com/wp-content/uploads/2023/02/Found-logo-600-300.png | 123 | SF | 2019 | $75 |

| http://fintechlabs.com/wp-content/uploads/2023/02/Logo-1.png | 101 | SF | 2021 | 181 |

| Company Overview | FAB Score* | Founded | Funding $M | |

|---|---|---|---|---|

| Ad | 2007 | $120,000 | NYC |

| 488 | 2020 | $950 | NYC |

| 362 | 2008 | 2500 | Atlanta |

| 309 | 2015 | 699 | Toronto |

| 282 | 2013 | $768 | SF |

| Company | FAB Score* | Founded | Funding ($M) | |

|---|---|---|---|---|

| 1058 | 2019 | $1,660 | NYC |

| 460 | 2008 | $401 | SF |

| 205 | 2016 | $312 | |

| 200 | 2016 | $418 | Utah |

| 196 | 2019 | $368 | NYC |

| FAB Score* | Founded | Funding ($M) | ||

|---|---|---|---|---|

| 230 | 2016 | $881 | SF | |

| 122 | 2017 | $520 | SF |

| 80 | 2017 | $306 | Wash DC |

| 63 | 2005 | $0 | London |

| 39 | 2015 | $142 | SF |